How To Read A Check

Checks have been around for quite some time now. However, that does not mean they are very easy to read and understand. It is important that you learn how to read a check especially if you are making a payment or cashing one at a bank. With Stock Check's simple guide, you will learn how to easily read a check in no time.

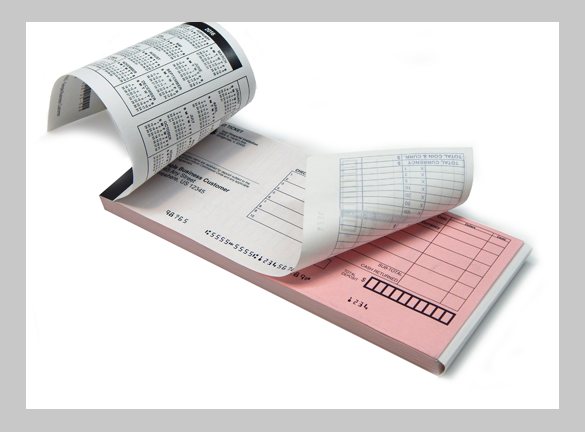

Parts Of A Check

Understanding the different parts of a check is the key to being able to read a check properly.

Personal Information On A Check

Usually found in the top left corner of a check. This area displays the account owner's personal information. It indicates the person or business's account where the funds will be withdrawn from.

For any reason you need to contact the check writer, you will find their contact information in this area.

Payee On Check

"Pay To The Order". This line indicates who the check is written to. Essentially establishing who will receive the funds. The person or business's name that is authorized to deposit or cash that check is written in this area.

The check may be "payable to cash". This just means anyone can cash or deposit the check.

Dollar Box (Numerical Amount)

The dollar box is the area of a check where you write the numerical amount the check is worth. It is usually referred to as a courtesy box since it is only on the check for convenience.

Check Amount (Written out In Words)

This part of a check is the official indicator of the check's amount. You fill out this section using words that reflect the dollar box amount.

The check amount indicates what you are legally entitled to as the payee.

Memo Line On A Check

The memo line on a check is used to provide additional information by the check writer. This area of the check explains what the check's payment is for. For example, paying rent.

Date Line On Check

The date line on a check indicates when a check was written.

The date line does not tell you when you are allowed to deposit the check. However, if a check is dated, check with the check writer before depositing. There is probably a good reason the check writer post-dated it.

Signature Line On A Check

The signature line on a check indicates who signed that particular check. This area is usually found in the bottom right-hand corner of a check.

If the check has no signature, this could cause problems when attempting to deposit it. Your bank could hit you with additional fees if the check is not accepted.

Your Bank's Contact Information

This part of a check indicates the bank from which the funds are being withdrawn from. This is the check writer's bank account.

If you wish to cash the check and receive the full amount, the bank listed here is the bank you need to go to.

ABA Routing Number

The ABA routing number on a check is the numerical address used to locate your bank. It is usually found at the bottom left of a check.

The routing number on a check allows other banks to collect funds from your bank account. These numbers are usually printed using a magnetic ink so computers can read them easily.

Account Number

The bank account number on a check indicates the bank account that the funds will come from. It is usually located at the bottom of a check in the center.

Check Number

The check number helps identify which check has been used and for what purpose. Since the account number is the same on all your checks, the check number keeps them organized.

Back Of A Check

The back of a check is where you endorse the document. Signing the back of a check is how you legally endorse a check for deposit.

Now that you know the different parts of a check, you will be ready to write your own or deposit one yourself. Should you need to order business checks, blank payroll checks, or blank check stock, we got you covered. Stock Checks provides the highest quality blank check paper at the best possible prices. If you are interested in free blank check stock samples, call us at (888)-391-7898 and we will gladly assist you.